The term "ICO" stands for Initial Coin Offering. An ICO is a way to raise money for a project. You can see it as crowdfunding. It occurs completely outside the financial system. An ICO is often used by crypto start-ups to get a flying start and raise a lot of money overnight. Many ICOs are scams and do not deliver what they promise. You can lose money by investing money in an ICO.

How does an ICO work?

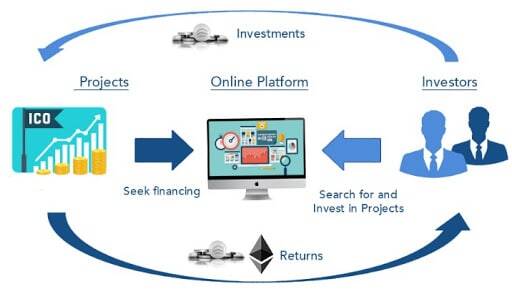

An ICO is intended to raise money for a crypto project or company. With an ICO, the project obtains capital to be able to develop the project. An ICO often lasts a week. During this week, it is possible for users to buy crypto from the project in exchange for, for example, Bitcoin or Ether. So the project gives its own crypto to the investor. Through an ICO you get the very first crypto that exists from the project. An important question is how much these ICOs are worth. This can be determined in roughly three ways:

- There are also crypto projects that offer a fixed number of crypto. But the price depends on the amount raised in the ICO. An advantage of the project's creators is that an infinite amount of money can be raised. So in this case, the price of the crypto gets higher when more money is raised.

- Some crypto companies have a specific goal or limit that they want to achieve with the ICO. This means that if an amount is reached that is set in advance, the ICO will stop. This ensures that the crypto you get from the ICO remains at a fixed price during the ICO and that the crypto sold during this period is fixed. So there is a static supply.

- Another form is the dynamic offering of crypto with a static price. Thus, the price of the crypto remains the same during and after the ICO. The only difference is that the supply of the crypto may vary during the ICO. This means that you can offer more crypto if more money is raised during the ICO. For example, for every Ether raised by the ICO, 1 additional crypto is created (from the project itself, of course). While the price is the same, the supply of crypto from the project itself increases as more money is raised.

What is the difference between an ICO and an IPO?

IPO stands for Initial Public Offering. An IPO takes place on the stock market and is very similar to an ICO. One similarity between an ICO and an IPO is that an IPO is an initial share issue. Investors can then buy these shares. An ICO is about the 'issuance' of the crypto of the project itself. This issue can be seen as an issue of initial shares, but in crypto. A big difference is that with an IPO, you actually become a shareholder of the company whose shares you bought. With an ICO, this is certainly not always the case. Another big difference is that an IPO is much more regulated by the banks and the government. An IPO is subject to rules. So there are a lot more restrictions and the risks are a lot smaller than with an ICO.

What should I look out for in an initial coin offering?

What should you pay attention to if you want to participate in an ICO? An ICO is a great way for the crypto world to raise money. But there are many risks involved and not without danger. Therefore, it is important to know who is the team behind the ICO. This must be transparent. If you can't find the team members through a brief Google search, that's a big red flag. But that's not the only factor you need to look at. Below I give a non-exhaustive list of factors you can look at.

- Who are the team members? Who is or are the founders of the ICO/project? And who are the developers of the crypto/ICO?

- Is there a whitepaper of the ICO available? It is important to look at the purpose/mission of the project. Also look at the timeline and whether it is feasible and realistic. Also check whether a technical analysis has been made and whether the code of the project/crypto is available.

- How is the money raised stored and managed? Is there an ICO escrow wallet and is the code on which their own crypto runs safe? Are there holes in the code? For a non-techie, this is not an easy question to answer. You can find several websites (free of charge) that analyse the code. A good example is marketmove.ai.

- Does the team have a customer service team that can answer your questions? Crypto projects often use a bot that answers questions. This bot does not necessarily have to be wrong, as long as you can always speak to a person. It is also important to find out how the project communicates about its developments. Is there a wallet that can store the crypto and if so, does it work well?

Above are briefly the points you should look at as an investor. It is often the case that if the above points are present, it is a safe ICO. But of course, this does not always have to be the case. But what is clear is that if you cannot answer the above questions or cannot answer them sufficiently, the ICO is a risky project.

ICO steps

What are the risks of investing in an ICO?

ICOs are not yet regulated. This means that a lot of scams are taking place. The ICO scams are sophisticated and they try everything to appear legitimate. It is very easy to build a website, make up names, create fake LinkedIn accounts, copy programming code, etc. What these scams also often do is create social media accounts to entice people to invest money in that ICO. Telegram is a well-known social media where many scams are active. When the creators of the ICO are satisfied with the money raised, the ICO disappears and the investors lose their money. This is also called a rug-pull.

An ICO is therefore not without risk. It is therefore good to do research on the project. If you do your research thoroughly, you will be able to invest very well and achieve good returns.

Pros and cons of ICOs

Pros

- Once a project is launched, the public can buy crypto immediately without an intermediary.

- ICOs usually rely on blockchain technology to keep a ledger of the various transactions. This reduces paperwork as everything is digital and data is updated within seconds.

- Some of the most successful ICOs of all time started with a low value and gradually increased their market value. The success of these types of ICOs is that they were able to offer something new to investors that other ICOs could not.

Cons

- Data leakages have become a constant threat during ICOs, which has an impact on the number of investors participating in these events.

- Perhaps the biggest problem with ICOs is that there are stolen funds (scams). Well-marketed ICOs usually attract many investors.

- A lot of players are able to create an own ICO. Difficult to distinguish the legit ICOs from scams. Scam ICOs often look very legit and solid.

Examples of successful ICOs

- The Ethereum project (crypto 'ETH'): raising $18 million over a period of 42 days.

- Antshares (now: NEO): During the ICO, NEO earned about $4.5 million

- Tezos : Tezos managed to raise about $232 million

- EOS: raising a whopping $4 billion during a year-long ICO

ICO websites

Interested in ICOs? Below a few websites that track (new) ICOs:

Reactie plaatsen

Reacties